Download app.

Join the Group.

...AND We WILL donate $10!

GO BIG BLUE!

FitnessBank is proud to partner with Marietta Tip Off Club. We will donate $10 for each FitnessBank Step Tracker downloaded.

Join the Group named "MHS Tip Off Club" with code 215015 to activate a donation.

About Our Partnership

FitnessBank & the Marietta Tip Off Club Have Big Things Planned

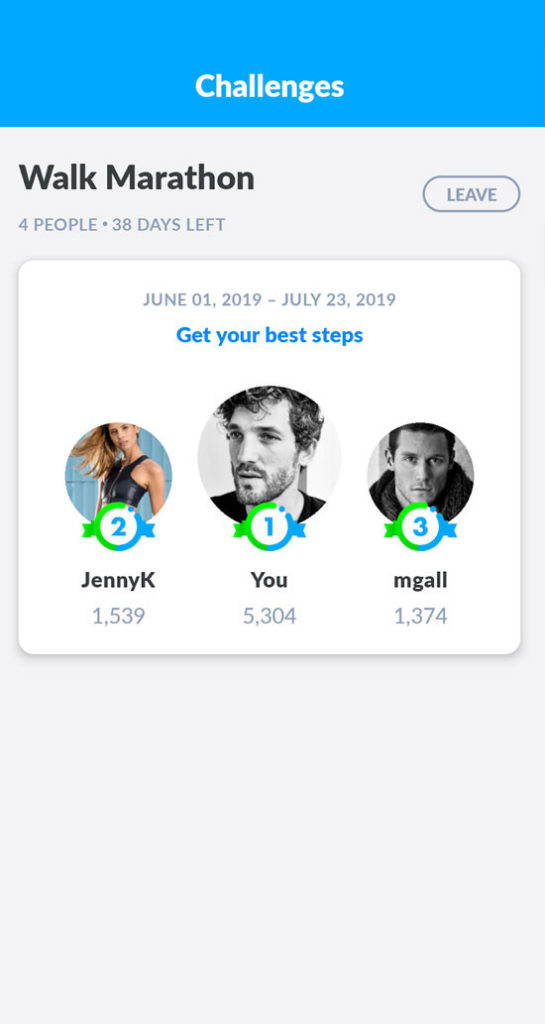

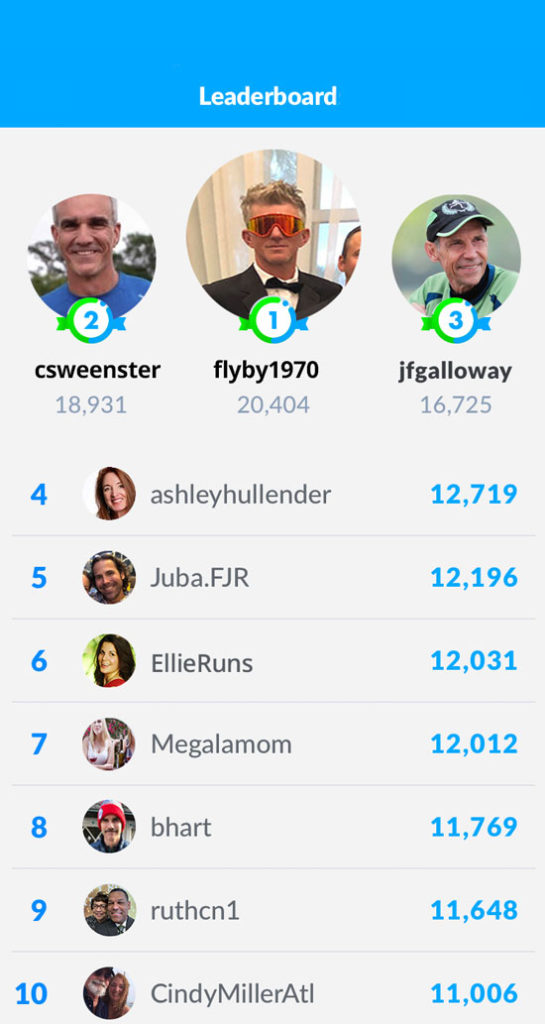

FitnessBank plans to provide step challenges for the Marietta Basketball community of students, staff, alumni, fans, families and friends as fundraisers benefiting the Blue Devils on the hard court for years to come.

Not only will we provide $10 for each app download, but we plan to provide bonuses for hitting individual and group step goals.

Nothing like a little healthy competition to encourage an active lifestyle. Keep on Stepp’n!

America's First Active Lifestyle Bank

We’re Stepping in the Right Direction by Creating Fundraising Opportunities for the Marietta Tip Off Club

RAISE MONEY FOR THE BOOSTER CLUB

1. Download the FitnessBank Step Tracker

2. Join the MHS Tip Off Club group on the app

3. December 1st join the 60-Day Tip Off Step Challenge – for every 1,000,000 steps the group counts, we will donate another $10.

It’s that easy and simple. One step at a time, we can build a strong and thriving booster club to support the boys and girls basketball programs.

Make Every Step Count

Learn More about FitnessBank

FitnessBank is a new online, lifestyle bank servicing clients across the United States. But we’re a bank with deep roots: FitnessBank is a division of Affinity Bank, which was established in 2002. For nearly two decades, we have served all types of small businesses and individuals with our full-slate of financial services.

What it means to be FDIC-Insured: The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that protects the funds depositors place in banks and savings associations. FDIC insurance is backed by the full faith and credit of the United States government. Since the FDIC was established in 1933, no depositor has lost a penny of FDIC-insured funds.

60-Day Step Challenge Fundraiser

FitnessBank will Donate $10 for Every 1,000,000 Steps the Group Counts with our Step Tracker App

Stating December 1st, FitnessBank will host the 60-Day Tip Off Club Step Challenge.

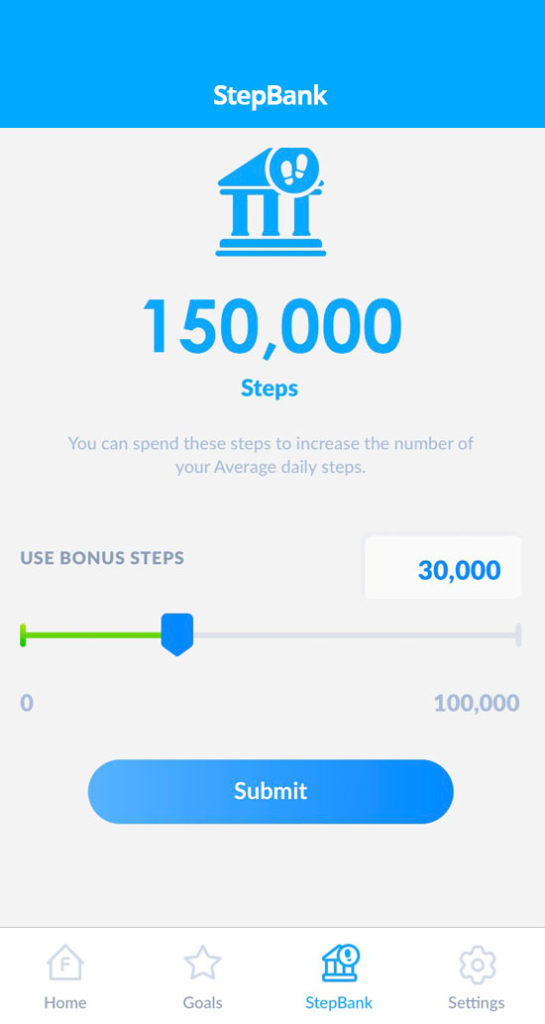

If you open a savings account with a minimum of $500, your steps will be counted twice.

Stay tuned for more details…

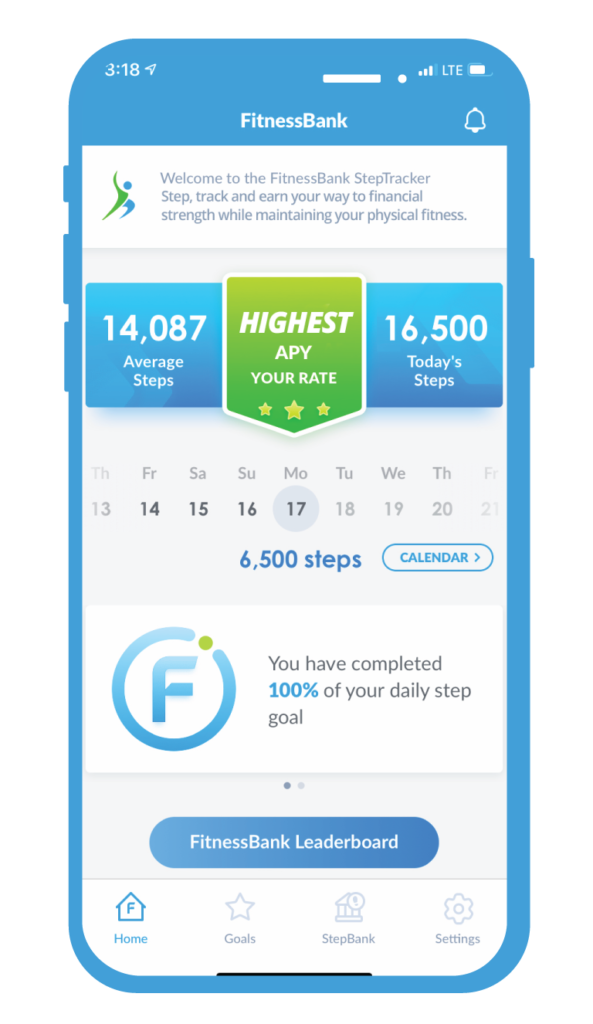

FitnessBank Step Tracker App

FitnessBank is an FDIC-insured lifestyle bank serving customers who pursue physical fitness and financial strength. With a Fitness Savings Account, you can earn an industry leading interest rate by tracking your daily step average each month. The more steps you take, the more money you make.

Each month the FitnessBank Step Tracker app gathers your average step count from Apple Health, Google Fit, FitBit or Garmin, and then matches it with our tiered Goals and Rates.

Have Questions? Need Help?

Check out our Frequently Asked Questions >>

Need help from our Customer Support Team? Contact Us >>