Train Harder.

Save Smarter.

Earn the Highest Interest Rates on the Planet.

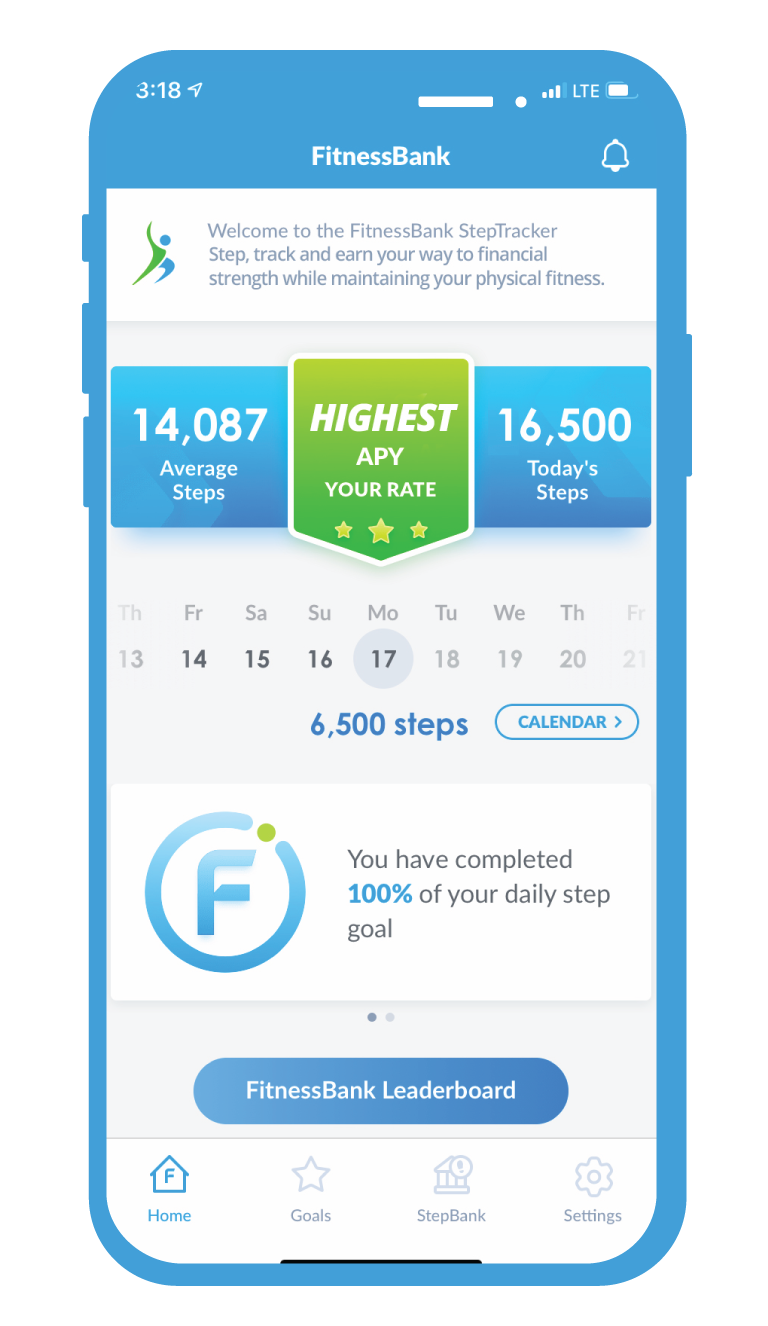

You’re already putting in the hard work. Now you can get paid while you get fit. Step, track, and earn the highest interest rates on the planet with a Fitness Savings Account or Senior Savings Account.

Get an Edge with each Training Session or on Race Day

AMERICA’S FIRST ACTIVE LIFESTYLE BANK is offering runners like you the chance to earn the highest interest rate savings account on the planet — the Fitness Savings Account — by tracking your steps.

The higher your average monthly step count. The higher your interest rate.

It’s that simple.

With FitnessBank you can Step. Track. And Earn a high interest rate on your Fitness Savings Account for the training, exercising and active lifestyle you already practice.

Earn a The Highest Interest Rate For Training Smart

“KEEP SHOWING UP and MAKE EVERY STEP COUNT with FitnessBank,” ~ Des Linden, Boston Marathon Champion & Two-time Olympian.

You’re already hitting the road, sticking to your training plan; why not make money for every step? It just makes sense.

FitnessBank uses your average daily step count at the end of the month to award the rate you earn.

Sync your activity tracker. Select your target step count and corresponding interest rate. Then, you’re on your way!

Make Every Step Count

Step Goals & Rates

After downloading the FitnessBank Step Tracker app and linking it with your Garmin, FitBit, Apple Health or Google Play; you can set your Step Goal based on our targets interest rate and physical fitness.This step will configure the app to notify you throughout each month as you Keep Stepp’n!

How We Can Offer These Rates

FitnessBank is an online bank servicing the United States from Atlanta, Ga.

FitnessBank has a nimble and efficient highly-trained staff with low overhead.

FitnessBank doesn’t buy TV ads during bowl games or golf events.

FitnessBank relies on the word-of-mouth to share our story.

Get A High Interest Savings Account in less than 2 minutes!

Driver’s License

or Passport

Social Security

Number

Bank Account

& Routing Number

OR Debit/Credit Card

Requirements

Fitness Savings Account

- Available to anyone who is at least 18 years of age, and a U.S. Citizen

- Account balances are capped at $250,000

- Interest is compounded daily, and credited monthly

- Incoming Wire Fee waived by FitnessBank

- $100 minimum opening deposit

- $10 maintenance fee, waived with $100 minimum average daily balance

- Interest earned on balances over $100

- Free online banking, external account transfers and eStatements

- $10 fee is charged for each additional withdrawal (withdrawal, automatic transfer or payment) in excess of the 6 permitted

- No step requirements for the first month

- Initial APY will be the top tier offered until the rate adjustment date following first full month that the account has been opened

- No debit/ATM cards available at this time

FDIC-Insured Member Bank

WHAT IT MEANS TO BE FDIC-INSURED

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that protects the funds depositors place in banks and savings associations. FDIC insurance is backed by the full faith and credit of the United States government. Since the FDIC was established in 1933, no depositor has lost a penny of FDIC-insured funds.